Will this be the way Europe works towards a solution?

I would not be surprised.

From Pragmatic Capitalism:

I’ve lived in Europe. I haven’t said much about this, but while others were calling for the disintegration of the euro – mostly from Americans not so familiar with the “European way” (Gartman, etc) – I believed this process was part of the plan all along. The standard European bureaucratic M.O. is to implement as much law as the people will allow for the moment, wait until an emergency develops, then continue the law you wanted to create in the first place, or at least another step of it. That’s how it works over there. I’m certain the central plan from early on was to consolidate treasuries, etc. But the people wouldn’t go for it at the time. Nationalism and such. So they needed to wait until a situation “forced their hand”. European politics, IMO, is much easier to read than American politics, which seem to sway in the wind every four years or so; I guess that part of it is predicable. Not that the European way is guaranteed to work or anything, just that there seems to be a consistent methodology to how policy happens over there. At some point in the future a situation will force them to combine military commands, too. But that’s much later. Europe is much more top-down controlled than the USA, it’s just fairly well hidden. Only those plucky Brits really fight against it. They’re like Europe’s Texas.

maandag 28 november 2011

woensdag 9 november 2011

Clarke and Dawe

How funny and accurate!

The debt crisis

European debt crisis

Quantative Easing

The Greek economy

The global economy

Global Collapse

How does the financial system work

The debt crisis

European debt crisis

Quantative Easing

The Greek economy

Global Collapse

How does the financial system work

vrijdag 4 november 2011

James Wolfensohn

Good video explaining a rapidly changing world by former Worldbank president James Wolfensohn.

zondag 30 oktober 2011

vrijdag 21 oktober 2011

vrijdag 7 oktober 2011

IMF advisor says we face a Worldwide Banking Meltdown

And another...

donderdag 6 oktober 2011

Rules of the game will be changed !!

Listen to the retoric. To defend America against speculators and unfair competition from abroad(10% import tax).

Fast forward tot today: expect the unthinkable in EU and US!

Fast forward tot today: expect the unthinkable in EU and US!

For history reason also a short video about the founding meeting at Bretton Woods in 1944.

And also FDR ends gold standard in 1933. What do we learn from these changes?

When the pressure becomes too big to handle, the rules will be changed, TO PROTECT YOU! NOT

woensdag 5 oktober 2011

Sustainable Finance Lab

Sustainable Finance Lab is a new initiative headed by Herman Wijffels (ex-Rabobank, ex-World Bank, ex-SER) to make the financial sector sustainable. A group of intellectuals discussing the current problems and searching a durable way forward. Involved are the Triodos Bank and the University of Utrecht. A good initiative, worth supporting.

On October 4th was the first evening in a series of five. Find the scheme for the remaining below (in Dutch):

To see the discussion follow this link: http://131.211.194.110/site1/SilverlightPlayer/Default.aspx?peid=da819f76456a4217af037e1980e518c7

Maandagavond 10 oktober – De financiële professionals: hoeder van de klant? Sprekers: Irene van Staveren met Esther-Mirjam Sent. Start: 20.00 uur – Eind: 22.00 uur

Maandagavond 31 oktober – Banken: private hoeders van het publiek belang. Sprekers: Hans Schenk en Harald Benink. Start: 20.00 uur – Eind: 22.00 uur

Maandagavond 7 november – Geld en Schuld. Sprekers: Arjo Klamer en Ewald Engelen. Start: 20.00 uur – Eind: 22.00 uur

Donderdagavond 24 november – Lessen en vragen voor de toekomst. Sprekers: Herman Wijffels, Klaas van Egmond e.a. Start: 20.00 uur – Eind: 22.00 uur

On October 4th was the first evening in a series of five. Find the scheme for the remaining below (in Dutch):

To see the discussion follow this link: http://131.211.194.110/site1/SilverlightPlayer/Default.aspx?peid=da819f76456a4217af037e1980e518c7

Eerste reeks

Maandagavond 3 oktober – Naar een dienstbare financiële sector. Sprekers: Herman Wijffels, Arnoud Boot en Peter Blom . Start: 20.00 uur – Eind: 22.00 uurMaandagavond 10 oktober – De financiële professionals: hoeder van de klant? Sprekers: Irene van Staveren met Esther-Mirjam Sent. Start: 20.00 uur – Eind: 22.00 uur

Maandagavond 31 oktober – Banken: private hoeders van het publiek belang. Sprekers: Hans Schenk en Harald Benink. Start: 20.00 uur – Eind: 22.00 uur

Maandagavond 7 november – Geld en Schuld. Sprekers: Arjo Klamer en Ewald Engelen. Start: 20.00 uur – Eind: 22.00 uur

Donderdagavond 24 november – Lessen en vragen voor de toekomst. Sprekers: Herman Wijffels, Klaas van Egmond e.a. Start: 20.00 uur – Eind: 22.00 uur

maandag 3 oktober 2011

zondag 2 oktober 2011

vrijdag 30 september 2011

Back to Mesopotamia? The Looming Threat of Debt Restructuring

BCG has issued a report worth reading: www.bcg.nl/documents/file87307.pdf

Below you will find a summary. Although the painted picture is gloomy, Enjoy!

We believe that some politicians and central banks - in spite of protestations to the contrary - have been trying to solve the crisis by creating sizable inflation, largely because the alternatives are either not attractive or not feasible:

Inflation will be the preferred option - in spite of the potential for social unrest and the difficult consequences for middle-class savers should it really take hold. However, boosting inflation has not worked so far because of the pressure to deleverage and because of the low demand for new credit. Moreover the inflation "solution" while becoming more tempting, may come to be seen as having economic and social implications that are too unpalatable. So what might the politicians and central banks do?

Since the publication of Stop Kicking The Can Down The Road, a number of readers have asked us what would happen if governments persisted in playing for time. To what measures might they have to resort? In this paper, we describe what might need to happen if the politicians muddle through for too much longer.

It is likely that wiping out the debt overhang will be at the heart of any solution. Such a course of action would not be new. In ancient Mesopotamia, debt was commonplace; individual debts were recorded on clay tablets. Periodically, upon the ascendancy of a new monarch, debts would be forgiven: in other news, the slate would be wiped clean. The challenge facing today's politicians is how clean to wipe the slates. In considering some of the potential measures likely to be required, the reader may be struck by the essential problem facing politicians: there may be only painful ways out of the crisis.

A Program for the United States

The situation in the U.S. is different from that of the euro zone and, in a way, would be less complicated to resolve. The U.S. has all the levers with which to address the crisis and would not need to coordinate 17 countries with divergent interest. But some facts would need to be acknowledged before decisive action could be taken:

Addressing the debt overhang.

The US would also need to reduce the debt overhang of the government, of consumer loans besides mortgages, and of non-financial corporate sector in the same way as in Europe. As exhibit 2 shows, the total debt overhang in the US equals $11.5 trillion or 77% of GDP. In the somewhat unlikely event of the US following the same path that Europe might pursue, a one-time wealth tax of 25% of financial assets would be required. As in Europe, this would also require the following initiatives.

Addressing the fundamental issues of the US Economy.

We have argued for a long time that the US economy needs to address some fundamental issues in order to become globally competitive again. In putting an end to muddling through, the government might also embark on a major restructuring of the economy:

All this is still speculation. But history shows that the US economy, like no other, is capable of adjusting and implementing quite radical changes. And in our view, some of the actions described above might be pursued by the US government if things do not improve soon.

BCG's conclusion:

Below you will find a summary. Although the painted picture is gloomy, Enjoy!

We believe that some politicians and central banks - in spite of protestations to the contrary - have been trying to solve the crisis by creating sizable inflation, largely because the alternatives are either not attractive or not feasible:

- Austerity - essentially saving and paying back - is probably a recipe for a long, deep recession and social unrest

- Higher growth is unachievable because of unfavorable demographic change and an inherent lack of competitiveness in some countries

- Debt restructuring is out of reach because the banking sectors are not strong enough to absorb losses

- Financial repression (holding interest rates below nominal GDP growth for many years) would be difficult to implement in a low-growth and low-inflation environment

Inflation will be the preferred option - in spite of the potential for social unrest and the difficult consequences for middle-class savers should it really take hold. However, boosting inflation has not worked so far because of the pressure to deleverage and because of the low demand for new credit. Moreover the inflation "solution" while becoming more tempting, may come to be seen as having economic and social implications that are too unpalatable. So what might the politicians and central banks do?

Since the publication of Stop Kicking The Can Down The Road, a number of readers have asked us what would happen if governments persisted in playing for time. To what measures might they have to resort? In this paper, we describe what might need to happen if the politicians muddle through for too much longer.

It is likely that wiping out the debt overhang will be at the heart of any solution. Such a course of action would not be new. In ancient Mesopotamia, debt was commonplace; individual debts were recorded on clay tablets. Periodically, upon the ascendancy of a new monarch, debts would be forgiven: in other news, the slate would be wiped clean. The challenge facing today's politicians is how clean to wipe the slates. In considering some of the potential measures likely to be required, the reader may be struck by the essential problem facing politicians: there may be only painful ways out of the crisis.

A Program for the United States

The situation in the U.S. is different from that of the euro zone and, in a way, would be less complicated to resolve. The U.S. has all the levers with which to address the crisis and would not need to coordinate 17 countries with divergent interest. But some facts would need to be acknowledged before decisive action could be taken:

- In spite of massive intervention by the Fed and the US government, growth remains anemic

- The deleveraging of private households will have to go on for many years

- The real estate market has not yet stabilized. About 11 million US households suffer from negative equity (their mortgage outstanding is higher than the value of their home). And the supply of homes is still in excess by 1.2 to 3.5 million (depending on the data used to estimate this number).

- The US government deficit is not sustainable and will need to be brought to acceptable levels, which will slow growth and amplify the problems of the private sector.

- In spite of a significant weakening in the dollar, the U.S. is still running a trade deficit that cannot be blamed on China alone. It reflects a lack of competitiveness in some key markets and the low proportion of manufacturing in the U.S. economy compared with countries such as Germany and Japan.

- There is a striking similarity between the US and Japan in the development of stock and real estate prices (See chart below). A correlation does not mean causality, but it is a sobering picture should Ben Bernanke and his team fail to reflate the economy.

- The interventions of the Fed, notably the programs designed to buy financial assets, have created a monetary overhang that could be the basis for sizable inflation in the future.

Addressing the debt overhang.

The US would also need to reduce the debt overhang of the government, of consumer loans besides mortgages, and of non-financial corporate sector in the same way as in Europe. As exhibit 2 shows, the total debt overhang in the US equals $11.5 trillion or 77% of GDP. In the somewhat unlikely event of the US following the same path that Europe might pursue, a one-time wealth tax of 25% of financial assets would be required. As in Europe, this would also require the following initiatives.

- Cleaning up the banking sector by calculating the losses and recapitalizing as needed – even if it means wiping out existing shareholders.

- Additional taxes on real estate, including an increased capital-gains tax to offset the support for the real-estate market.

- Creating an incentive for corporations to invest in R&D and new machinery by taxing profits not reinvested.

- A commitment by the government to restrict its debt level and to prepare for the increasing costs of an aging population by either limiting benefits or raising the retirement age.

Addressing the fundamental issues of the US Economy.

We have argued for a long time that the US economy needs to address some fundamental issues in order to become globally competitive again. In putting an end to muddling through, the government might also embark on a major restructuring of the economy:

- Reindustrialize and grow the share of the manufacturing sector from the current low of 12% of GDP to 20% of GDP . This might then allow a rebalancing of trade flows.

- Revisit income distribution. Most U.S. families cannot make up for their income shortfall with increased credit – and 41 million Americans are officially considered to be below the poverty line.

- Take action to reduce dependency on imported oil by investing in new technologies and modernizing existing infrastructure.

- As in Europe, an administration that truly bit the bullet would take a long-term view and invest more in education.

All this is still speculation. But history shows that the US economy, like no other, is capable of adjusting and implementing quite radical changes. And in our view, some of the actions described above might be pursued by the US government if things do not improve soon.

BCG's conclusion:

The programs we have described would be drastic. The would not be popular, and they would require broad political coordinate and leadership – something that politicians have replaced up til now with playing for time, in spite of a deteriorating outlook. Acknowledgment of the facts may be the biggest hurdle. Politicians and central bankers still do not agree on the full scale of the crisis and are therefore placing too much hope on easy solutions. We need to understand that balance sheet recessions are very different from normal recessions. The longer the politicians and bankers wait, the more necessary will be the response outlined in this paper. Unfortunately, reaching consensus on

such tough action might requiring an environment last seen in the 1930s.

A new democratic revolution is sweeping northern Europe

Nigel Farage, as always very bright and eloquent on Europe on the 28th of September 2011.

Mr Barroso,

You told us this morning that the European Union is an inspiration. And whilst you admitted to there being one or two little economic problems, you made it perfectly clear that jobs and growth were to follow, that everything is going well – in fact you painted a vision that a new period of European renewal is upon us.

Now as a former communist yourself you probably remember the old soviet leaders getting up to give their speeches and telling everybody that there was a record harvest, or that tractor production figures were terribly good.

And they of course believed that history was on their side and in fact President Krushchev got up and said to the West ‘We will bury you,” so much did he believe in his own Union.

Well now of course we look back at that and we laugh. And I think in our tomorrows, people will look back at you, and they will say ‘how did this unelected man get all of this power?’

And how did Europe’s political class sitting in this room decide that the community method [federal] should replace national democracy.

I think people will look back in astonishment that we’ve surrendered democracy.

But what you want to do is to say, right, we have a European Union and what we’re going to have to do now is to have more of it. So as an architect – and you’re one of the key architects of the current failure – what we’re going to do, even though everything to date has been wrong – we’re going to do more of the same.

Now I thought that was a definition of madness. I can’t believe that is a rational response to any situation in which you find yourself. And far from it being a ‘State of the Union’ I would argue that the Union is in a state.

Because, just look at the confusion. We’ve got you as the President of the Commission. We’ve got a President of the European Parliament. We’ve got my old friend Herman Van Rompuy, who is the permanent president of the European Council. We’ve got the Poles – they’re now presidents temporarily [Poland holds six-month EU Council presidency] of the European Council.

We’ve got presidents all round this room, goodness me, even I am a president. I’m not sure what the collective noun for presidents is, perhaps it’s ‘incompetence’, I don’t know. But certainly when you take away democratic accountability, it’s clear nobody is in charge.

And it’s developing as a Union of intolerance. Anybody that stands up here and dares to give a political view that is different to the received wisdom is written off as mad, insane, violent, fascist – we’ve heard it for years from these people.

And the intolerance is so deep that when we get referendums in France, the Netherlands and Ireland that reject your view, you see it – as a political class – as a problem to be overcome.

So I’m very worried about the whole root of this Union. There is a new [euro-] nationalism that is sweeping Europe. You want to abolish the nation states – in your case, Mr Schulz, becuase you’re ashamed of your past – and you now want this flag and a new anthem to replace nation states and you don’t care how you get there. If you have to crush national democracy. If you have to oppose popular referendums – you just sweep this aside and say that it’s ‘populism’. Well, it’s not, it’s democracy.

And what is sweeping northern Europe now, starting off in April with that amazing result in the Finnish general election, is there is a new democratic revolution sweeping northern Europe. It’s not anti-European. It wants a Europe of trade; it wants a Europe of cooperation; it wants a Europe where we can do student exchanges, where we can work in eachother’s capital cities – it wants those things.

But it does not want this European Union.

Frankly, you are all now yesterday’s men.

(There followed a ‘Blue Card’ question by Andrew Duff MEP, Lib Dems – ALDE Group)

Mr Barroso,

You told us this morning that the European Union is an inspiration. And whilst you admitted to there being one or two little economic problems, you made it perfectly clear that jobs and growth were to follow, that everything is going well – in fact you painted a vision that a new period of European renewal is upon us.

Now as a former communist yourself you probably remember the old soviet leaders getting up to give their speeches and telling everybody that there was a record harvest, or that tractor production figures were terribly good.

And they of course believed that history was on their side and in fact President Krushchev got up and said to the West ‘We will bury you,” so much did he believe in his own Union.

Well now of course we look back at that and we laugh. And I think in our tomorrows, people will look back at you, and they will say ‘how did this unelected man get all of this power?’

And how did Europe’s political class sitting in this room decide that the community method [federal] should replace national democracy.

I think people will look back in astonishment that we’ve surrendered democracy.

But what you want to do is to say, right, we have a European Union and what we’re going to have to do now is to have more of it. So as an architect – and you’re one of the key architects of the current failure – what we’re going to do, even though everything to date has been wrong – we’re going to do more of the same.

Now I thought that was a definition of madness. I can’t believe that is a rational response to any situation in which you find yourself. And far from it being a ‘State of the Union’ I would argue that the Union is in a state.

Because, just look at the confusion. We’ve got you as the President of the Commission. We’ve got a President of the European Parliament. We’ve got my old friend Herman Van Rompuy, who is the permanent president of the European Council. We’ve got the Poles – they’re now presidents temporarily [Poland holds six-month EU Council presidency] of the European Council.

We’ve got presidents all round this room, goodness me, even I am a president. I’m not sure what the collective noun for presidents is, perhaps it’s ‘incompetence’, I don’t know. But certainly when you take away democratic accountability, it’s clear nobody is in charge.

And it’s developing as a Union of intolerance. Anybody that stands up here and dares to give a political view that is different to the received wisdom is written off as mad, insane, violent, fascist – we’ve heard it for years from these people.

And the intolerance is so deep that when we get referendums in France, the Netherlands and Ireland that reject your view, you see it – as a political class – as a problem to be overcome.

So I’m very worried about the whole root of this Union. There is a new [euro-] nationalism that is sweeping Europe. You want to abolish the nation states – in your case, Mr Schulz, becuase you’re ashamed of your past – and you now want this flag and a new anthem to replace nation states and you don’t care how you get there. If you have to crush national democracy. If you have to oppose popular referendums – you just sweep this aside and say that it’s ‘populism’. Well, it’s not, it’s democracy.

And what is sweeping northern Europe now, starting off in April with that amazing result in the Finnish general election, is there is a new democratic revolution sweeping northern Europe. It’s not anti-European. It wants a Europe of trade; it wants a Europe of cooperation; it wants a Europe where we can do student exchanges, where we can work in eachother’s capital cities – it wants those things.

But it does not want this European Union.

Frankly, you are all now yesterday’s men.

(There followed a ‘Blue Card’ question by Andrew Duff MEP, Lib Dems – ALDE Group)

maandag 26 september 2011

Be prepared!

Well said by Alessio Rastani. The world is not run by governments but by Goldman Sachs. They don't care if the Euro is saved or not. They just want to make money. Markets are going to crash and millions of people are going to lose their savings.

donderdag 22 september 2011

Deflation

Deflation is a proces. We have excess capacity to produce in the world, the desire to save instead of spend by the people, increasing the money supply is irrelevant because the system to get the money working in the economy is broken (M1 multiplier is well below 1) http://research.stlouisfed.org/fred2/series/MULT and don't forget that the austerity measures taken by governments are highly deflationary.

How deflation works out is well described by Robert Prechter, the deflation specialist.

From "Conquer the Crash"

How deflation works out is well described by Robert Prechter, the deflation specialist.

From "Conquer the Crash"

"...a lender starts with a million dollars and the borrower starts with zero. Upon extending the loan, the borrower possesses the million dollars, yet the lender feels that he still owns the million dollars that he lent out. If anyone asks the lender what he is worth, he says, 'a million dollars,' and shows the note to prove it. Because of this conviction, there is, in the minds of the debtor and the creditor combined, two million dollars worth of value where before there was only one. When the lender calls in the debt and the borrower pays it, he gets back his million dollars. If the borrower can’t pay it, the value of the note goes to zero. Either way, the extra value disappears...

"The dynamics of value expansion and contraction explain why a bear market can bankrupt millions of people. At the peak of a credit expansion or a bull market, assets have been valued upward, and all participants are wealthy -- both the people who sold the assets and the people who hold the assets. The latter group is far larger than the former, because the total supply of money has been relatively stable while the total value of financial assets has ballooned. When the market turns down, the dynamic goes into reverse. Only a very few owners of a collapsing financial asset trade it for money at 90 percent of peak value. Some others may get out at 80 percent, 50 percent or 30 percent of peak value. In each case, sellers are simply transforming the remaining future value losses to someone else. In a bear market, the vast, vast majority does nothing and gets stuck holding assets with low or non-existent valuations. The 'million dollars' that a wealthy investor might have thought he had in his bond portfolio or at a stock’s peak value can quite rapidly become $50,000 or $5000 or $50. The rest of it just disappears. You see, he never really had a million dollars; all he had was IOUs or stock certificates. The idea that it had a certain financial value was in his head and the heads of others who agreed. When the point of agreement changed, so did the value. Poof! Gone in a flash of aggregated neurons. This is exactly what happens to most investment assets in a period of deflation."

woensdag 21 september 2011

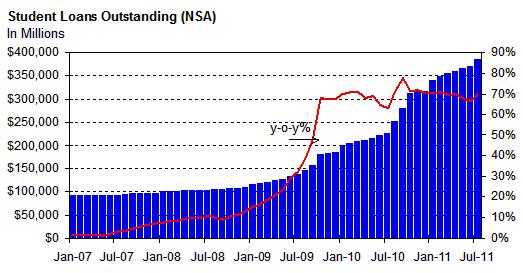

Student loans

Buried!

Posted By thestatedtruth.com on September 18, 2011

We have literally buried our young college students with a debt burden that will change their lives for decades. But nobody’s paying attention as the colleges need every penny they can get. Looking at the chart below, it’s shocking to see that student debt has almost quadrupled in less then three years! Shocking!The unemployment rate for people aged between 20 to 24 years was 24.5% in August, up from 23.1% in July. The unemployment rate for this population range averaged 15% from 2002 through the end of 2007. However, as the labor market continued to struggle, the unemployment rate for persons between 20 and 24 years of age rose to 25.7% in November 2009 and has remained elevated over the past two years. Not to mention that the unemployment rate for the civilian labor force has been above 9% since May 2009. Additionally we suspect the increased cost of tuition is forcing students to take out larger loans in order to pay for rising education costs.

dinsdag 20 september 2011

Adjiedj Bakas

Trendwatcher Adjiedj Bakas geeft ons een lesje geschiedenis!

http://www.bakas.nl/Grieken bliezen ook voorganger Euro op – Waarom leren we niet uit verleden?

- 19/09/2011 11:09

Nu de eurozone op het punt staat uit elkaar te barsten, is het goed eens te kijken naar een paar van zijn voorlopers. Anders dan we vaak denken, is de Europese Economische en Monetaire Unie (EMU) niet zo uniek. De Europese geschiedenis kent verschillende muntunies, die allemaal om dezelfde redenen ter ziele zijn gegaan.

Nu de eurozone op het punt staat uit elkaar te barsten, is het goed eens te kijken naar een paar van zijn voorlopers. Anders dan we vaak denken, is de Europese Economische en Monetaire Unie (EMU) niet zo uniek. De Europese geschiedenis kent verschillende muntunies, die allemaal om dezelfde redenen ter ziele zijn gegaan.Een van die voorgangers is de LMU, de Latijnse Monetaire Unie, in 1865 in het leven geroepen door België, Frankrijk, Zwitserland en Italië. De bedoeling was de continentaal-Europese economieën te versterken. De franc kreeg een vaste waarde van 0,29 gram goud of 4,5 gram zilver. De munten van de andere landen werden aan de franc gekoppeld. Onder andere Spanje en Griekenland traden eveneens toe. Door de koppeling van de valuta konden de nationale munten binnen de hele unie worden gebruikt. Het vergemakkelijkte onderlinge handel en zorgde voor stabielere wisselkoersen, zodat voordeliger op de kapitaalmarkt kon worden geleend. Er was geen gemeenschappelijke munt was, zodat de lidstaten geld konden bijdrukken als dat nodig was.

Bekend in de oren klinkt dat Griekenland en Spanje failliet gingen, toen ze ondanks hun lidmaatschap niet meer voordelig op de kapitaalmarkten terecht konden. En de Grieken belazerden de boel, zij het niet door met begrotingscijfers te goochelen, maar met het goudgehalte van de drachme. In 1908 werden ze uit de muntunie gegooid. De LMU zat toen al in het slop, maar wist haar bestaan te rekken tot 1927.

Geïnspireerd door de LMU sloten Zweden, Denemarken en Noorwegen in 1873 de Scandinavische Muntunie. Ze voerden een nieuwe munt in, de kroon, met een gouden standaard: 1 gram goud was 2,48 kronen. Ook erkenden ze elkaars munten als wettig betaalmiddel en brachten de nationale banken geen kosten in rekening voor onderlinge transacties. Het einde van deze unie kwam in 1914, toen Zweden de gouden standaard losliet.

Wat beide muntunies de das omdeed, was dat landen hun eigen financiële en economische beleid voerden, ten koste van elkaar en de unie. Dit is ook de zwakte van de EMU. De architecten van de Euro wisten dit, maar dachten een politieke unie op een later moment te kunnen forceren. Een misrekening. De erosie van de democratie en het zwakke politieke leiderschap, geleefd door opiniepeilingen en populisme, staat integratie in de weg.

Maar een monetaire unie zonder politieke eenheid is een transferunie, waarin rijke regio’s geld overboeken naar armere. Dat geeft spanningen, tenzij de arme regio’s wat hebben om terug te geven. Binnen de eurozone is dat niet het geval. Nu we aan de vooravond staan van de splitsing van de Euro in een harde Neuro en een zwabberende Zeuro wordt dat pijnlijk duidelijk.

Er is echter een monetair verhaal dat ruimte biedt voor een andere toekomst: de Oostenrijkse Maria Theresia Thaler, in 1751 geïntroduceerd. De Thaler groeide uit tot een internationale handelsmunt, die zelfs in het Midden-Oosten, Afrika en Amerika gebruikt werd. De munt was zo populair dat de Amerikaanse dollar zijn naam eraan dankt, net als onze rijksdaalder. Tot ver in de twintigste eeuw werden Thalers geslagen en op sommige Arabische bazaars zijn ze nog altijd in gebruik.

Het is een inspirerend voorbeeld voor de Euro. In plaats van de onze munt de nek om te draaien, moeten we zwakke landen misschien de ruimte geven hun eigen geld er naast te hebben. Dan kunnen de Grieken weer drachmen slaan, terwijl we vasthouden aan de gemakken en (nooit serieus onderzochte) voordelen van een Euro die gefundeerd is op de economische kracht van West-Europa.

maandag 19 september 2011

Bill Bonner

Beautiful description by Bill Bonner on the aging of western economies and its consequences.

For the last 3 or 4 centuries the winning formula for developed economies and their governments has been simple: More energy. More output. More people. More credit. More promises. This formula has been so effective for so long people began to think it was destiny itself. It’s not. Instead, it is slave to destiny not its master.

For full article read: Destiny is Demography http://dailyreckoning.com/destiny-is-demography/

For the last 3 or 4 centuries the winning formula for developed economies and their governments has been simple: More energy. More output. More people. More credit. More promises. This formula has been so effective for so long people began to think it was destiny itself. It’s not. Instead, it is slave to destiny not its master.

For full article read: Destiny is Demography http://dailyreckoning.com/destiny-is-demography/

vrijdag 16 september 2011

Building a cruise vessel

Beautiful video of the construction of the Avalon Affinity by the Den Breejen shipyard

Scott Carver The world's best banker

Introducing Scott Carver, the world's best banker.

Overview by Fintan Dunne - 1st July, 2011

- Makes Gordon Gekko look like a wet liberal.

- Thinks Goldman Sachs are pussies.

- Eats nations. Shits CDO's.

- Makes so much money that the Feds owe HIM Income Tax!

- Has refused to take on the Bank of England

because he doesn't "do small stuff."

- Once called economist Michael Hudson a

"more dangerous fuggin' Commie than Mao."

Overview by Fintan Dunne - 1st July, 2011

- Makes Gordon Gekko look like a wet liberal.

- Thinks Goldman Sachs are pussies.

- Eats nations. Shits CDO's.

- Makes so much money that the Feds owe HIM Income Tax!

- Has refused to take on the Bank of England

because he doesn't "do small stuff."

- Once called economist Michael Hudson a

"more dangerous fuggin' Commie than Mao."

dinsdag 13 september 2011

History of money and taxes

Does anybody still think about the reason why we pay taxes? When did taxation start? Is it the best way for a government to raise money?

Will it ever be enough? Isn't the government designed to serve the people? I have the impression that the government is getting bigger and bigger, tells us they are there to look after us, but is giving us a misleading sense of collective safety. We are afraid to be alone and need our big brother to look after us, we take the occasional beating for granted. We have to learn to look after ourselves again. Not each individual on its own, but a civilised society where we take care of the people in our circle of influence. Government needs to decrease, we must rethink the way we pay for things.

Martin Armstrong gives us a good lesson in this valuable piece http://armstrongeconomics.files.wordpress.com/2011/09/armstrongeconomics-bound-to-past-090811.pdf

Will it ever be enough? Isn't the government designed to serve the people? I have the impression that the government is getting bigger and bigger, tells us they are there to look after us, but is giving us a misleading sense of collective safety. We are afraid to be alone and need our big brother to look after us, we take the occasional beating for granted. We have to learn to look after ourselves again. Not each individual on its own, but a civilised society where we take care of the people in our circle of influence. Government needs to decrease, we must rethink the way we pay for things.

Martin Armstrong gives us a good lesson in this valuable piece http://armstrongeconomics.files.wordpress.com/2011/09/armstrongeconomics-bound-to-past-090811.pdf

dinsdag 30 augustus 2011

CDS risks in Europe

When it comes to the stability of the European dominoes, let’s think for a moment about Italy, which is not only the second worst country in Europe after Greece on a debt/GDP basis, but also the country with the largest amount of nominal debt, and more importantly Italy has the largest amount of net CDS outstanding. All this is summarized on the Bloomberg chart below.

zondag 28 augustus 2011

Questions about the European debt

Fundamental questions on the European debt.

Move your money into US dollar?

vrijdag 26 augustus 2011

Abonneren op:

Posts (Atom)